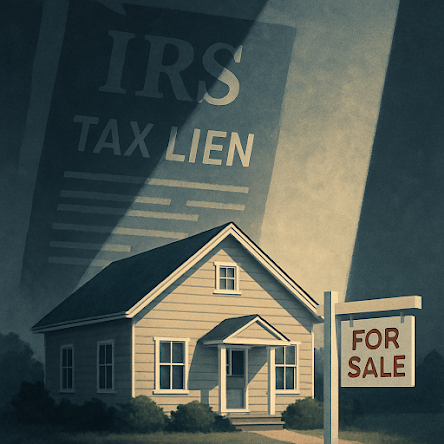

Selling a house is an endeavor often fraught with emotion, but when tangled with the complexities of an IRS tax lien, it can elevate stress levels exponentially. For homeowners facing this situation, the mixture of anxiety and pressure can be daunting. An IRS tax lien puts a legal claim against your property due to unpaid tax debts, creating a substantial hurdle when trying to sell a home. This situation can evoke feelings of embarrassment and annoyance, as finances come under scrutiny.

However, partnering with a tax professional can turn this overwhelming experience into a manageable process. The role of a tax professional extends beyond mere numbers; they provide emotional relief by lifting the burden of tax-related stress and worry. With their expertise, they ensure seamless communication with the IRS, eliminating the fear of harassment and unexpected future tax surprises. This not only alleviates the feeling of isolation but instills confidence, freeing clients from the weight of potential financial penalties.

The shame of not having been able to file tax returns can be transformed into constructive action. A tax professional ensures that clients are not only compliant but also optimistic about their financial future. By removing the veneer of exposure and vulnerability, clients can focus on selling their property with peace of mind.

In essence, while an IRS tax lien can seem like an impregnable barrier, it doesn't have to stop you from successfully selling your home. With the guidance of a seasoned tax professional, the path forward is not one of trepidation but one of confidence and clarity. This collaboration ensures that clients are not simply navigating financial challenges, but are also reassured of a secure financial future.

Ready to stop IRS stress and take back control? Click here to schedule your tax relief call now and start your journey toward peace of mind today

No comments:

Post a Comment